Ok

Personal Loan Information

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

Applicant Information

Monthly Expenses

(Optional) This area may be used to take a picture or upload copies of your last 2 paychecks or W2.

Almost Done

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Additional Applicant Information

Monthly Expenses

(Optional) This area may be used to take a picture or upload copies of your last 2 paychecks or W2.

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

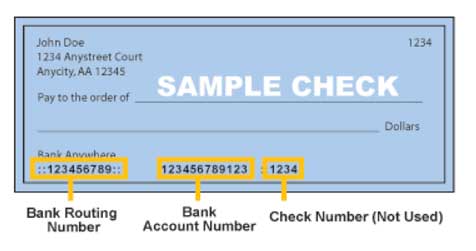

Deposit Account Information

Review and Submit

Because membership is required to take advantage of this wonderful loan product, please tell us how you qualify for membership.

Northwest Federal will deposit the $1 membership share into your primary savings account. This minimum balance is required to maintain your membership with the credit union.

APY: 0.05% Min Deposit: $0.00 Max Deposit: $100.00

Enjoy convenient account access and save money with this free checking account featuring no monthly maintenance fees or minimum balance requirements.

Max Deposit: $5,000.00

Our dividend-earning account features no monthly maintenance fee when you maintain a $5,000 average monthly balance. You can earn a higher dividend rate with $1,000 minimum in deposits per month to the account.

APY: 0.02% Max Deposit: $5,000.00

Earn higher dividends with a Rewards Savings account when you have a Debit Rewards checking account. “Please note: if you have already opened a Northwest Federal Debit Rewards checking account, only Rewards Savings will be added to your account.”

No minimum balance requirement for Rewards Savings or Debit Rewards.

Earn higher dividends with a Rewards Savings account when you have a Debit Rewards checking account. “Please note: if you have already opened a Northwest Federal Debit Rewards checking account, only Rewards Savings will be added to your account.”

No minimum balance requirement for Rewards Savings or Debit Rewards.

Save for seasonal expenses, such as holiday purchases, vacations or even your yearly personal property tax bill. Choose your initial disbursement date and funds will be transferred to your Primary Savings account annually on that date.

APY: 0.05% Min Deposit: $0.00 Max Deposit: $100.00

APY: 0.05% Min Deposit: $0.00 Max Deposit: $100.00

Want dividends and checking flexibility? Our Money Market Account (MMA) makes it possible. Featuring a higher dividend rate than our standard savings account, a Money Market Account also lets you enjoy flexibility, convenience, and protection.

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

APY: 0.05% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

APY: 0.11% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 4.10% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 4.10% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 4.10% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 3.60% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 3.60% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 3.60% Min Deposit: $1,000.00

Max APY: 3.60% Min Deposit: $1,000.00

Our "select your own certificate" program provides investment flexibility, generous earnings and the advantage of a fixed rate for the term you choose. Rates vary according to the deposit amount and term in days selected.

Max APY: 3.60% Min Deposit: $1,000.00

Your funds will not be transferred until all of your accounts are approved

Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company, is available for most loan products

Would you like more information about protecting your loan payment or balance with Credit Life and Credit Disability Insurance from your lender?Debt Protection is available with most loans by the credit union. It is designed to cancel your loan payment or balance, up to the contract maximums, if a protected life event occurs. Available package options will include one or more of the following life events: Life, Disability or involuntary unemployment.

Would you like more information about protecting your loan payment or balance with Debt Protection from your lender?MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP) is an optional protection product made available by the credit union. In the event of a total loss, GAP is designed to cancel the difference between your primary insurance settlement and the outstanding loan balance, up to the contract maximums. For more information, call or visit the credit union.

Would you like more information about protecting your loan with GAP from your lender?Mechanical Repair Coverage can help you limit the cost of covered vehicle breakdowns.

Would you like more information about Mechanical Repair Coverage from your lender?By clicking the “I Agree” button you authorize Northwest Federal Credit Union to complete ID verification and to access your credit file to authenticate your identity and facilitate the processing of this application or other related financial services as submitted now or in the future. You understand that you may be asked questions based on the information in your credit file, as part of this process, and that NWFCU may obtain and review your credit history and past banking relationships before accepting this account.

Authentication Questions

Co-Authentication Questions

Account Information

Application Completed

reCAPTCHA Verification Failure

Error: E-004

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Access Denied

You're logged in as

You're logged in as