Open an Account

Supercharge your savings with our NEW Power Savings Account. Earn our highest rate of return – 5.50% APY* - on your first $1,000. This account is great for the beginning saver with no minimum balance required (sometimes referred to as reverse tier savings).

Min Deposit: $500.00

This account has everything you need to complete your day-to-day banking. You can save money on things you're already paying for, plus there's no minimum balance required.

Discover all the Benefits

- Cell Phone Protection

- Identity Theft Aid

- Roadside Assistance

- And more!

This account offers a variety of flexible options to get your teen started on the right financial path. Specifically for ages 13-17.

- Debit Card—Four Free CO-OP ATM withdrawals per month

- Mobile Banking and Mobile Card Controls

- Automatic “Allowance” Transfers.

This checking account pays interest and comes with exclusive benefits powered by BaZing, plus there's no minimum balance requirement.

If you frequently use your debit card and want to earn high interest, this is the account for you.

This is a great starter checking account for anyone looking for an everyday, low cost account that includes all the essentials.

Created for young adults between 18-26 years old.

Get off to a great start with a checking account that has no monthly fees and gives you access to thousands of ATMs and branches nationwide.

Use a secondary savings account for any savings goal. Life is full of fun and adventure, so let us help you plan accordingly.

Use a Christmas Club Account to save for the holidays year-round. The money you deposit will automatically transfer to your checking account on the 1st of November. Just in time to shop for the holidays!

- Competitive tiered dividend rates

- Minimum balance of $1,000.00 to earn dividends*

- Checks available upon request

A Health Savings Account (HSA) is a tax-advantaged savings account for people covered by a High Deductible Health Plan (HDHP). Funds in your HSA can be used for qualified medical expenses, such as prescriptions and co-pays.

With a traditional IRA contributions can be taken as tax deductions in the tax year they are made. Both contributions and earnings are tax-deferred until the funds are withdrawn.

- Tax-deferred earnings (potentially tax-deductible contributions)*

- Federally insured up to $250,000.00

- Earnings grow tax free.

- Designed for any age as long as you have earned income, including non-working spouses of wage earners.

Contributions to a Roth IRA are taxed as income in the year they are deposited. Thus, contributions cannot be taken as tax deductions. However, at the time of withdrawal, the earnings on those contributions are not taxable.

- Federally insured up to $250,000.00

- Earnings grow tax free.

- Designed for any age as long as you have earned income, including non-working spouses of wage earners.

An Education IRA, also known as a Coverdell IRA, is a tax-advantaged investment account designed to encourage savings to cover future education expenses (elementary, secondary, or college), such as tuition, books, and uniforms.

Consult a tax advisor.

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

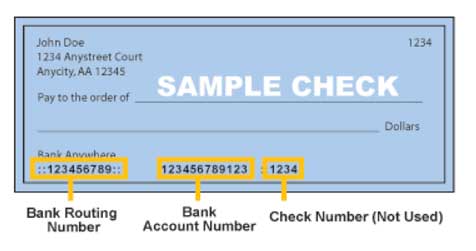

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

Additional Documents

Some good options are:

- Utility Bill or other bill

- Recent Paystub

- Insurance Card

- Lease Agreement or Mortgage Statement

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

Additional Documents

Some good options are:

- Utility Bill or other bill

- Recent Paystub

- Insurance Card

- Lease Agreement or Mortgage Statement

Beneficiaries Information

Review and Submit

Your application is not complete until you read the disclosure below and click the "I Agree" button in order to submit your application.

You are now ready to submit your application! By clicking on "I agree", you authorize us to verify the information you submitted and may obtain your credit report. Upon your request, we will tell you if a credit report was obtained and give you the name and address of the credit reporting agency that provided the report. You warrant to us that the information you are submitting is true and correct. By submitting this application, you agree to allow us to receive the information contained in your application, as well as the status of your application.

Authentication Questions

reCAPTCHA Verification Failure

Error: E-004

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as