New Membership

Membership is open to all of Erie County! If you live, work, worship, volunteer, or attend school in Erie County, you are eligible to become a member of Buffalo Metropolitan Federal Credit Union. Businesses and other legal entities located in Erie County, and immediate family of current members, are also eligible to join.

In the event your eligibility to join the Credit Union cannot be proven with the documentation submitted during this account opening process, you may be asked to submit further documentation (e.g. a pay stub illustrating you work in Erie County or a birth certificate showing relationship with an existing member).

APY: 0.25% Min Deposit: $25.00

Our FREE checking/draft account has no minimum balance requirement and no monthly usage fees regardless of the balance you keep in your account. Our online services (online banking, online bill pay, mobile banking and mobile check deposit) are ALWAYS FREE.

Min Deposit: $0.00 Max Deposit: $2,500.00

College students enjoy a free checking account and a waived monthly debit card fee and foreign ATM fees (note a surcharge may be imposed by the ATM owner).

With our MMA you earn more than with a savings account and the number of transactions per month is unlimited. There is no set term and dividends are paid quarterly on accounts with an average daily balance of $2,500.00 or more. Note: Electronic withdrawals/debits are not available with a MMA. Rates as of 7/1/24.

Max APY: 1.00% Min Deposit: $0.00

Certificate will not be opened until sufficient funds are provided. *Share certificate special, including the stated Annual Percentage Yield (APY*) are a limited time offer. Buffalo Metropolitan Federal Credit Union reserves the right to modify or cancel these offers at any time without notice. The share certificate special requires a minimum deposit of $2,500.00 with new funds. New funds are funds that have not been on deposit with Buffalo Metropolitan Federal Credit Union in the past 30 days. Upon maturity, the share certificate special will automatically renew for 12 months at the then current rate of our 12-month share certificate, unless otherwise specified. APY=Annual Percentage Yield. Rate as of 8/14/24. Federally insured by NCUA. Early withdrawal penalties apply. Dividends paid at maturity. Membership eligibility required. Other restrictions may apply.

Max APY: 3.75% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/24. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 1.51% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 2.00% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 2.14% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 2.23% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 2.44% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 2.87% Min Deposit: $500.00

Banks offer certificates of deposit (CDs); credit unions offer Share Certificates. Put your money to work for you by opening a Share Certificate and earn a higher rate of return! We have many different terms to meet your specific objectives. Terms range from six months to sixty months. Dividends paid at maturity. Annual Percentage Yield effective 9/26/2024. If funds are withdrawn from any Share Certificate account prior to maturity of the current term of the account, a substantial penalty will be imposed.

Max APY: 3.71% Min Deposit: $500.00

Open a holiday club account at Buffalo Metropolitan and you'll be prepared for holiday expenses. No minimum balance requirement, no monthly usage fees, and no reason not to start saving today.

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

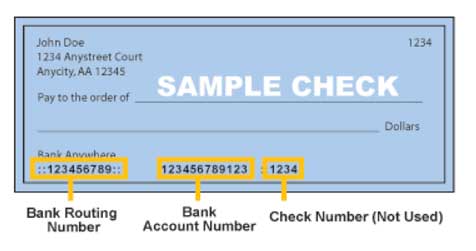

To open an account online, you will need to upload the following which will allow us to identify you:

- 1st Requirement – Non expired Government ID (driver’s license or non-driver’s license with current address, Passport, U.S. Military ID, or other Government Issued ID)

- 2nd Requirement – Social security card, birth certificate, a recent pay stub, work ID, or benefit card with picture and signature

- 3rd Requirement only applicable if your ID does not include a current address - Utility bill, charge account billing, or pay-stub as proof of current residence

In the event your identity cannot be verified, a Credit Union Representative will contact you to discuss other options in opening your account.

Please upload the required identification documentations as explained above.

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

To open an account online, you will need to upload the following which will allow us to identify you:

- 1st Requirement – Non expired Government ID (driver’s license or non-driver’s license with current address, Passport, U.S. Military ID, or other Government Issued ID)

- 2nd Requirement – Social security card, birth certificate, a recent pay stub, work ID, or benefit card with picture and signature

- 3rd Requirement only applicable if your ID does not include a current address - Utility bill, charge account billing, or pay-stub as proof of current residence

In the event your identity cannot be verified, a Credit Union Representative will contact you to discuss other options in opening your account.

Please upload the required identification documentations as explained above.

Beneficiaries Information

Review and Submit

Your application is not complete until you read the disclosure below and click the "I Agree" button in order to submit your application.

You are now ready to submit your application! By clicking on "I agree", you authorize us to verify the information you submitted and may obtain your credit report. Upon your request, we will tell you if a credit report was obtained and give you the name and address of the credit reporting agency that provided the report. You warrant to us that the information you are submitting is true and correct. By submitting this application, you agree to allow us to receive the information contained in your application, as well as the status of your application.

Authentication Questions

reCAPTCHA Verification Failure

Error: E-004

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as