New Membership

Patriot Act - Notice

Important Information About Procedures for Opening a New Account:To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person (business and individuals) who opens any financial transaction account(s) including deposits, loans and safe deposit boxes.

What this means for you:

When you open any financial transaction account, we will ask for your name, address (mailing and physical, if different), date of birth, and other information that will allow us to identify you. We will also ask to see your driver’s license or other identifying documents.

In all cases, protection of our applicant’s identity and confidentiality is our pledge to you.

CONSENT TO ELECTRONIC RECORDS

To apply for an account through our online account application, you must consent on the disclosure page to the E-Sign Agreement. By consenting, you agree to receive legal disclosures, agreements, notices and documents electronically.

Should you decide to not receive related documents electronically, please exit our online account application.

We welcome your interest in applying for an account and would be happy to assist you in opening an account at any of our banking centers.

This is the membership account for MMFCU. The Primary Share Account is required.

APY: 0.20% Min Deposit: $5.00

Want to save for a certain thing? Keep your funds separate in a separate savings account.

APY: 0.20%

Saving for an upcoming trip? Choose this account and set up direct deposit to put your savings on auto pilot.

APY: 0.20%

Want to save for the holidays? Choose this account and set up direct deposit to put your savings on auto pilot.

APY: 0.20%

The companion savings account to our Kasasa Cash checking. Earn a great rate on balances up to $50,000 (must have Kasasa Cash checking to qualify for this account).

The companion savings account to our Kasasa Cash Back checking. Earn a great rate on balances up to $50,000 (must have Kasasa Cash Back checking to qualify for this account).

Earn great dividends on your checking account on balances up to $10,000! Refunds up to $25 on ATM fees monthly, no fees.

Earn up to $6 cash back every month on your debit card purchases, refunds up to $25 on ATM fees monthly, no minimum balance, no fees.

Tiered rate/balance account. Our best interest rates while keeping your funds liquid.

Min Deposit: $100.00

APY: 3.04% Min Deposit: $500.00

APY: 3.30% Min Deposit: $500.00

APY: 4.18% Min Deposit: $500.00

APY: 3.51% Min Deposit: $500.00

APY: 3.61% Min Deposit: $500.00

APY: 3.71% Min Deposit: $500.00

APY: 2.68% Min Deposit: $500.00

APY: 2.68% Min Deposit: $500.00

APY: 2.68% Min Deposit: $500.00

APY: 3.81% Min Deposit: $50,000.00

APY: 2.78% Min Deposit: $50,000.00

APY: 2.78% Min Deposit: $50,000.00

APY: 2.78% Min Deposit: $50,000.00

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

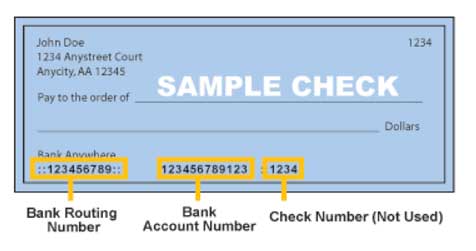

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

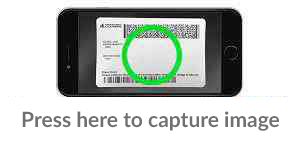

Please upload a copy of your Government Issued Identification

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

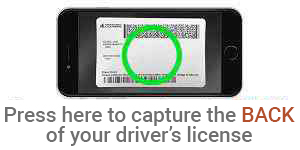

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

Please upload a copy of your Government Issued Identification

Beneficiaries Information

Review and Submit

Your application is not complete until you read the disclosure below and click the "I Agree" button in order to submit your application.

You are now ready to submit your application! By clicking on "I agree", you authorize us to verify the information you submitted and may obtain your credit report. Upon your request, we will tell you if a credit report was obtained and give you the name and address of the credit reporting agency that provided the report. You warrant to us that the information you are submitting is true and correct. By submitting this application, you agree to allow us to receive the information contained in your application, as well as the status of your application.

Authentication Questions

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as