New Membership

Join Directions - and enjoy the many BENEFITS of a Credit Union!

What will we need from you? To make this process faster and easier, please have the following information:

•Social Security Number for all applicants

•Driver’s License (front & back) or government issued ID for all applicants

•A picture of you holding the selected ID with information legible

•Personal information (Birthdate, Address, Employer, etc.)

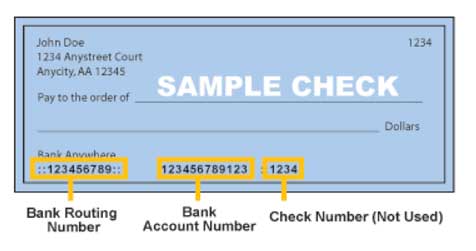

•Information for funding your new account (existing Directions Credit Union account number or a credit/debit card).

For more information regarding our rates please click Truth in Savings Disclosure

Your $5 ownership share in our financial cooperative joins you with 95,000 other community members in Michigan and Ohio working together to achieve financial health and peace of mind. Deposit more if you would like, it all earns interest.

APY: 0.10% Min Deposit: $5.00 Max Deposit: $5,000.00

Directions Debit Card with Scorecard Rewards earns points as you spend. Easy, convenient, secure online/mobile access lets you deposit, transfer, pay bills, and manage 24/7. Alerts and fraud protection provide ease of mind. And best of all, NO monthly maintenance fees.

APY: 0.00% Min Deposit: $25.00 Max Deposit: $5,000.00

APY: 0.05% Min Deposit: $25.00 Max Deposit: $5,000.00

APY: 0.10% Min Deposit: $25.00 Max Deposit: $5,000.00

Make budgeting and saving for lifestyle goals easy. Saving for braces, vacations, weddings, and monthly expenses is easy with a secondary savings account that earns interest. Open one for each saving goal and score on financial health.

APY: 0.10% Max Deposit: $5,000.00

Boost your earning power while maintaining easy access to your funds. The higher your deposit balance, the greater your interest rate. NCUA insured to keep your money safe.

APY: 0.30% Max Deposit: $5,000.00

Prepare for the Holidays so you can relax and enjoy time with family and friends. Let our Holiday Club help you budget for all your holiday expenses, a deposit at a time, so you can celebrate in comfort. Interest on your savings is the gift that keeps on giving.

APY: 0.10% Max Deposit: $5,000.00

Big savings goals deserve an extra earnings boost. The higher your deposit balance, the greater your interest rate. Maintain easy access to your funds while saving for a down payment or other major lifestyle goals. NCUA insured to keep your money safe.

APY: 0.05% Max Deposit: $5,000.00

APY: 3.82% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.07% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.28% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.28% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.28% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.28% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.23% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.28% Min Deposit: $500.00 Max Deposit: $100,000.00

APY: 4.33% Min Deposit: $500.00 Max Deposit: $100,000.00

Application Cancelled

We have cancelled your application.

If this was a mistake and you would like to fix errors you can return to the application now.

Funding

This account does not have sufficient balance to cover the total required deposit.

Please select another account.

'Doing Business As' Information

Tell Us About Yourself

Please upload the following documentation. This is required for your application to be processed unless you are an existing member.

- Picture of front & back of ID type selected above

- A picture of you holding the selected ID with information legible

- If current address does not match ID, please upload proof of address in the form of a utility bill, lease agreement, W2, phone bill, or paystub

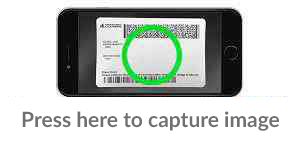

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

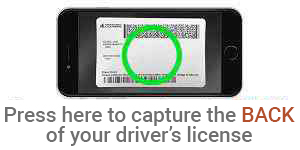

Recommendation for best recognition:

* Use a dark background

* Make sure all four corners are visible

* Avoid glare

* Make sure image is in focus

Joint Applicant Information

Please upload the following documentation. This is required for your application to be processed unless you are an existing member.

- Picture of front & back of ID type selected above

- A picture of you holding the selected ID with information legible

- If current address does not match ID, please upload proof of address in the form of a utility bill, lease agreement, W2, phone bill, or paystub

Beneficiaries Information

Review and Submit

By clicking "I agree", you authorize us to obtain a credit history about you and joint applicant.

Authentication Questions

Application Completed

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

Congratulations

Funds Pending

Almost Done

You're logged in as

You're logged in as